Not known Facts About Do I Have To List All My Assets and Debts When Filing Bankruptcy?

The debt avalanche tactic includes having to pay the financial debt with the best curiosity very first and dealing down from there. The benefit of this method would be that the less you pay back in curiosity, the more cash you ought to have available to place toward the principal repayment.

Choosing a filing date on your bankruptcy on which your banking account is “artificially” high. On some dates, your checking account may glimpse quite balanced, Despite the fact that you know you can find a slew of automated deductions and checks on their own way in.

When listing assets in bankruptcy, debtors have to file an entire report of all asset kinds they personal. As Element of the bankruptcy filing procedure, debtors will have to deliver the court that has a list in their assets, also called a program of assets.

Finally It will likely be up to the creditor to maintain the account open, so discuss with your creditor to start with and make sure you go over it with them before assuming they will let you retain the account.

Two several years for Chapter seven bankruptcy (You'll have both equally a long time to finish the paperwork and the most recent calendar year with the bankruptcy trustee.)

Chapter seven bankruptcy is effective properly for people who own generally the critical products necessary to Reside and do the job and never Considerably else. Those with far more assets could eliminate them in Chapter 7 because the Chapter seven trustee, the Formal chargeable a fantastic read for the case, sells unneeded luxurious things and distributes the proceeds to creditors.

No minimum amount amount of credit card debt is required to file for possibly Chapter 7 or Chapter thirteen bankruptcy. However, it’s crucial to think twice about your condition and weigh your choices just before doing this, since it’s a choice that could have ripple effects with your finances.

We have been an independent, advertising and marketing-supported comparison service. Our target is to help you make smarter fiscal choices by giving you with interactive resources and fiscal calculators, publishing original and aim written More Help content, by enabling you to definitely perform investigate and Review information and facts free of charge - so that you can make financial decisions with self esteem.

Consolidation financial loans have fastened terms and fixed fascination prices, so you can acquire control of your credit card debt, know just when you're going to be credit card debt-absolutely free, and pay back your personal debt speedier. So how exactly does financial debt consolidation operate?

But this compensation does not impact the information we publish, or perhaps the evaluations that you just see on This page. We don't incorporate the universe of providers or fiscal gives that may be accessible to you.

After you have retained your legal blog professional, it check over here generally will acquire a number of weeks to have everything typed up, assembled, diligently reviewed and submitted Using the bankruptcy court docket. However, before filing, it's essential to get involved in someone or team briefing that outlines prospects for credit score counseling.

You shouldn't send out any sensitive or confidential details via This great site. Any facts despatched through This great site won't make a lawyer-shopper marriage and might not be treated as privileged or confidential.

However it should really only be pursued as a last resort, as it will hurt your credit rating and have a peek at these guys effects your funds. Consider financial debt payoff approaches, personal debt consolidation loans, reevaluating your finances or dealing with a credit card debt relief enterprise, among the other choices to have out of credit card debt without having filing bankruptcy.

The bankruptcy notation on your credit score profile plus the Preliminary fall in credit score score can make it more challenging to borrow dollars at reasonable costs to the foreseeable upcoming.

Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Soleil Moon Frye Then & Now!

Soleil Moon Frye Then & Now! Traci Lords Then & Now!

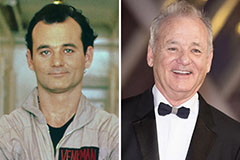

Traci Lords Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!